Irs Section 179 Deduction 2025. This limit is reduced by the amount by which the cost of section 179 property. Once businesses spend more than.

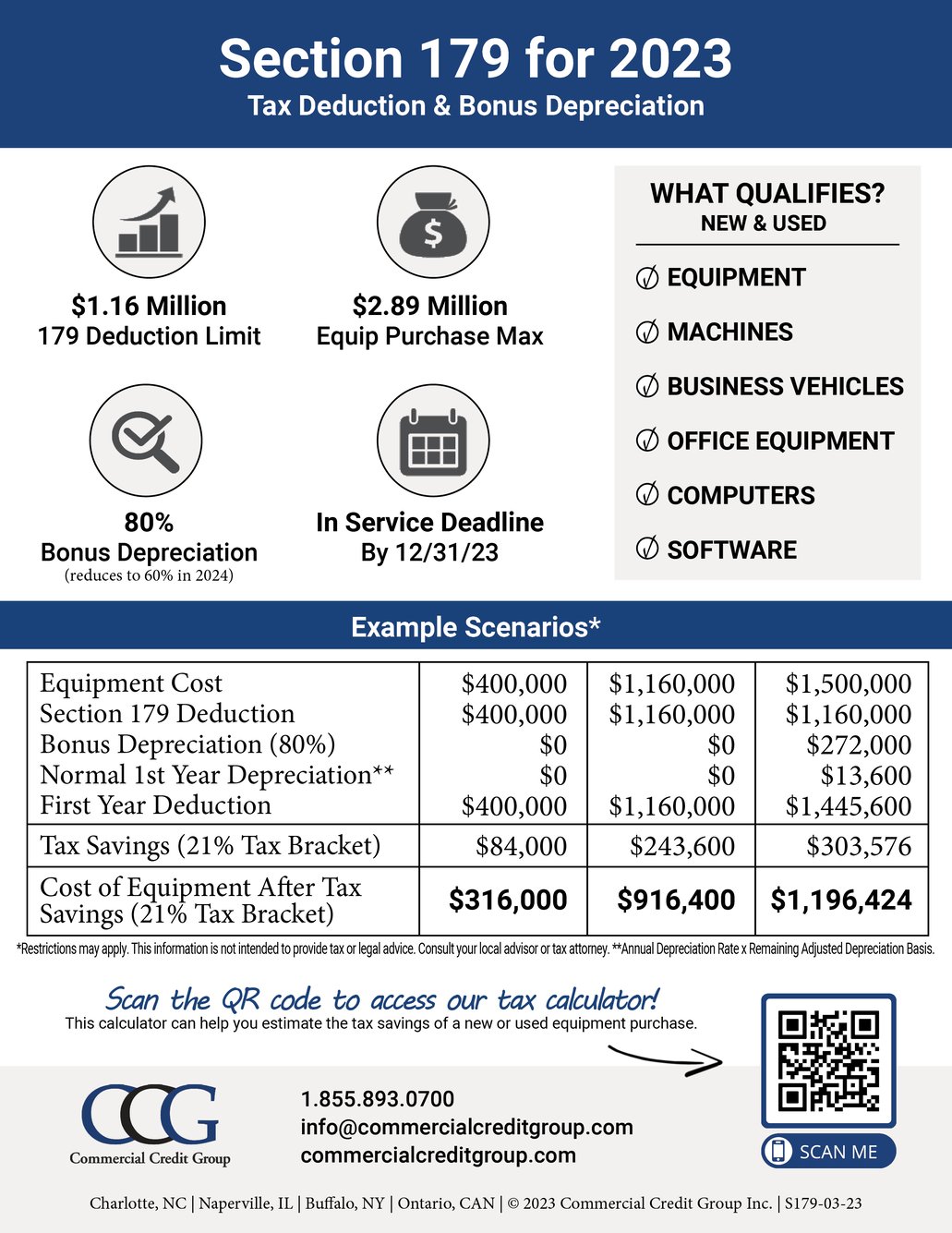

The section 179 deduction limit for tax year 2025 is $1,160,000 with an investment limit of $2,890,000.

Section 179 Tax Deduction, Claiming section 179 depreciation expense on the company's federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. Phase down of the special depreciation allowance for certain property.

Section 179 IRS Tax Deduction Updated for 2025, For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000. But as always, the details matter.

section 179 calculator, Section 179 deduction dollar limits. Phase down of the special depreciation allowance for certain property.

Irs New Tax Brackets 2025 Romy Carmina, This limit is reduced by the amount by which the cost of section 179 property. There also needs to be sufficient.

Section 179 Tax Deductions Infographic GreenStar Solutions, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. For 2025, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, Claiming section 179 depreciation expense on the company's federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. There also needs to be sufficient.

Section 179 Deduction and NonProfits Understanding The Section 179, In 2025, this limit is. If you’re a us company, you might already know about a u.s.

Section 179 Tax Deduction (Infographic), Section 179 deduction dollar limits. Bonus depreciation (60% in 2025):

2022Section179deductionexample QTE Manufacturing Solutions, Calculate your potential 2025 tax savings in seconds. This deduction allows for the upfront expense of tangible property like machinery and office equipment, providing an immediate tax break instead of spreading.

8+ Section 179 Deduction Vehicle List 2025 Everything You Need To, Deductions for owners of passenger automobiles placed in service by the taxpayer. For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000.

This deduction allows for the upfront expense of tangible property like machinery and office equipment, providing an immediate tax break instead of spreading.