Highly Compensated 401k Limits 2025. For 2025, the contribution limit is $23,000. $345,000 (up from $330,000) catchup contribution for people aged 50 or older:

The 401 (k) contribution limit in 2025, including both employee and employer contributions, is $66,000 or $73,500 with catch. The 401 (k) contribution limits for 2025 are $22,500, or $30,000 if you’re 50 or older.

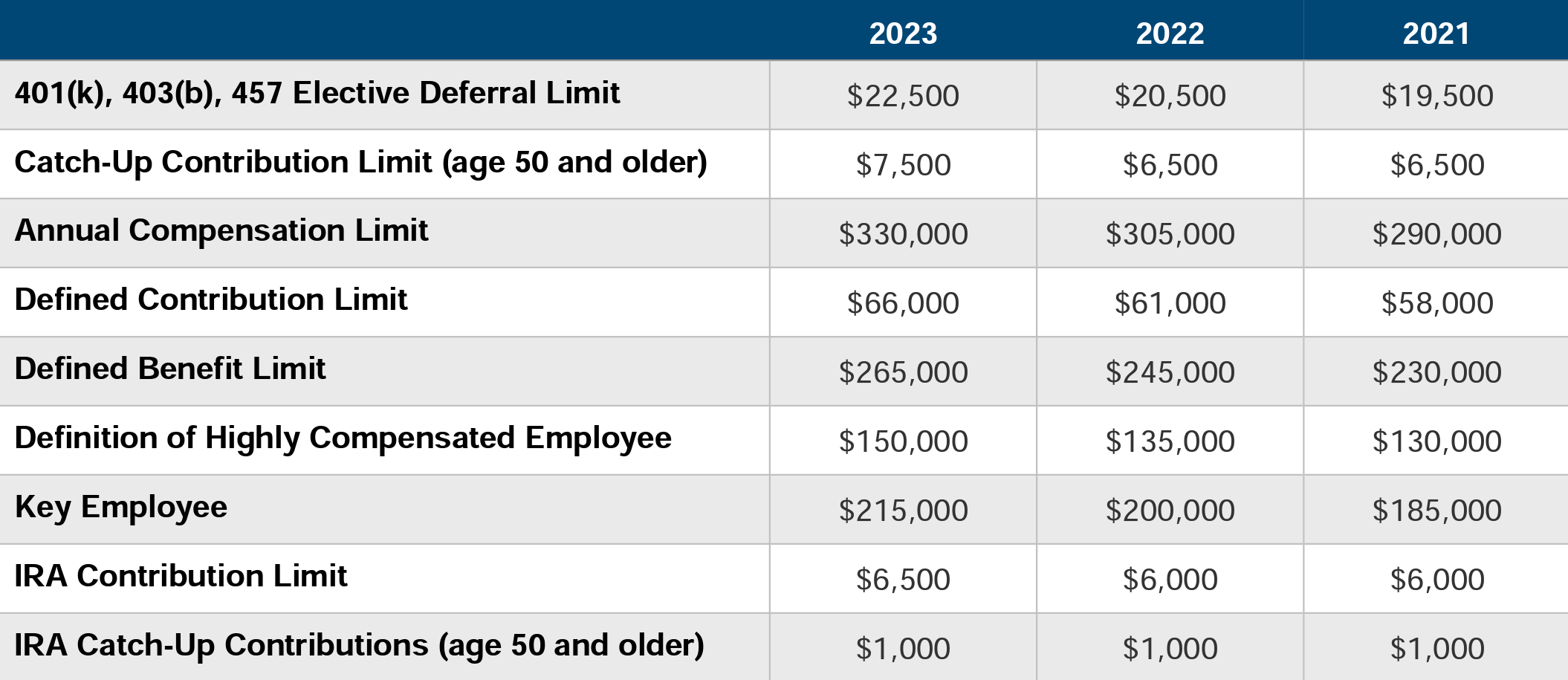

As the table above illustrates, the 2025 irs limit for employee 401(k) contributions jumped up $500 from the 2025 mark of $22,500.

What Is The 401k Compensation Limit For 2025 Opal Jacquelin, If you're age 50 or. The combined limit for employee and employer.

After Tax 401k Contribution Limits 2025 Hana Quinta, As the table above illustrates, the 2025 irs limit for employee 401(k) contributions jumped up $500 from the 2025 mark of $22,500. Limits for highly paid employees.

2025 IRS Limits on Retirement Benefits and Compensation — Cadence, Since the plan includes a basic match, your employer matches 100% of your contributions up to 3% of your salary ($1,200), and 50% on the next 2% ($200),. The limit on elective deferrals under 401 (k), 403 (b), and eligible 457 (b) plans increased to $23,000.

401k Limits for Highly Compensated Employees for 2025 401k, Show me, The plan sponsor has only allocated. $7,500 (no change) total defined.

401k limits for highly compensated employees Pay Stubs Now Blog, Compensation limit in calculation of qualified deferral and match: As the table above illustrates, the 2025 irs limit for employee 401(k) contributions jumped up $500 from the 2025 mark of $22,500.

Financial Articles & News from Ken Gibbons Financial Engineering LLC, A 401(k) safe harbor plan was established in 2018. $19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;.

401 Contribution Limits 2025 Over 50 Daron Emelita, Compensation limit in calculation of qualified deferral and match: For 2025, the contribution limit is $23,000.

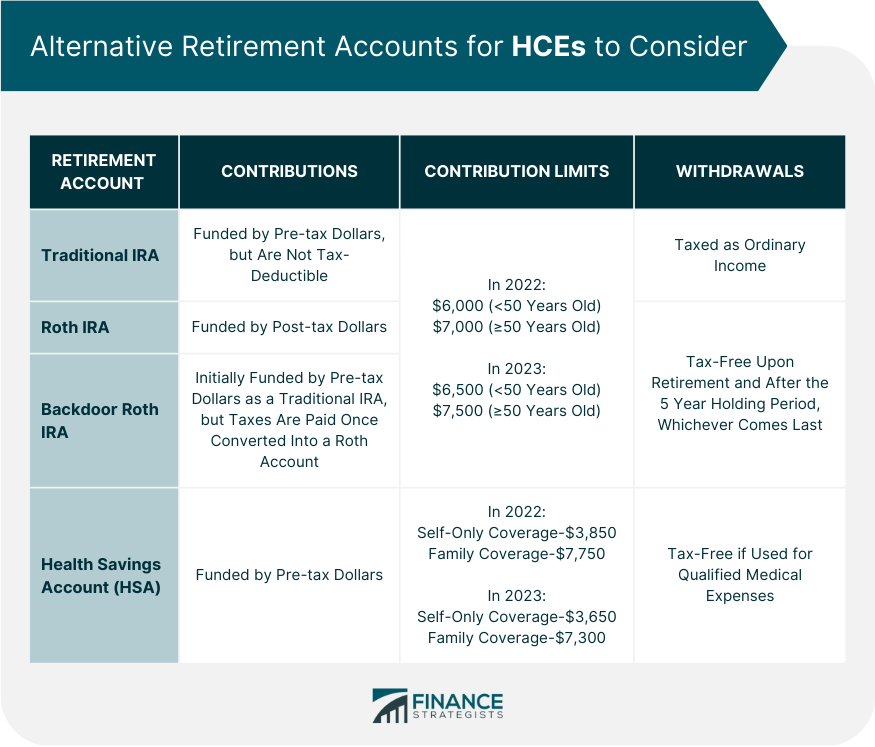

401(k) Contribution Limits for 2025, The irs adjusts this limit. Individuals receiving yearly compensation that exceeds $155,000 in 2025 or $150,000 in 2025 are considered hces.

401K Plans Secure Act 2.0 from Bad to Worse Highly Compensated, Limits for highly paid employees. A 401(k) safe harbor plan was established in 2018.

401(k) Contribution Limits for Highly Compensated Employees, In 2019, the plan sponsor decided that hces would be excluded from the safe harbor contribution, but failed to amend the plan document to reflect its intent. The 2025 401 (k) contribution limit for employees was $22,500.

Since the plan includes a basic match, your employer matches 100% of your contributions up to 3% of your salary ($1,200), and 50% on the next 2% ($200),.

Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.